5 New Business Jets Arriving in 2026 and What They Mean for Your FBO

Published on December 30, 2025 • 6 min read

Your hangar just got more complicated.

The Cessna Citation CJ4 Gen3 enters service in 2026 with Garmin's Emergency Autoland. Touch that aircraft wrong during towing and you might trigger a $50,000 sensor repair. The Dassault Falcon 10X takes its maiden flight with the widest cabin in business aviation—9 feet 1 inch across. And Honda is building a light jet that flies coast-to-coast on a single pilot certificate.

These aren't incremental upgrades. They're operational inflection points for every FBO handling business aviation.

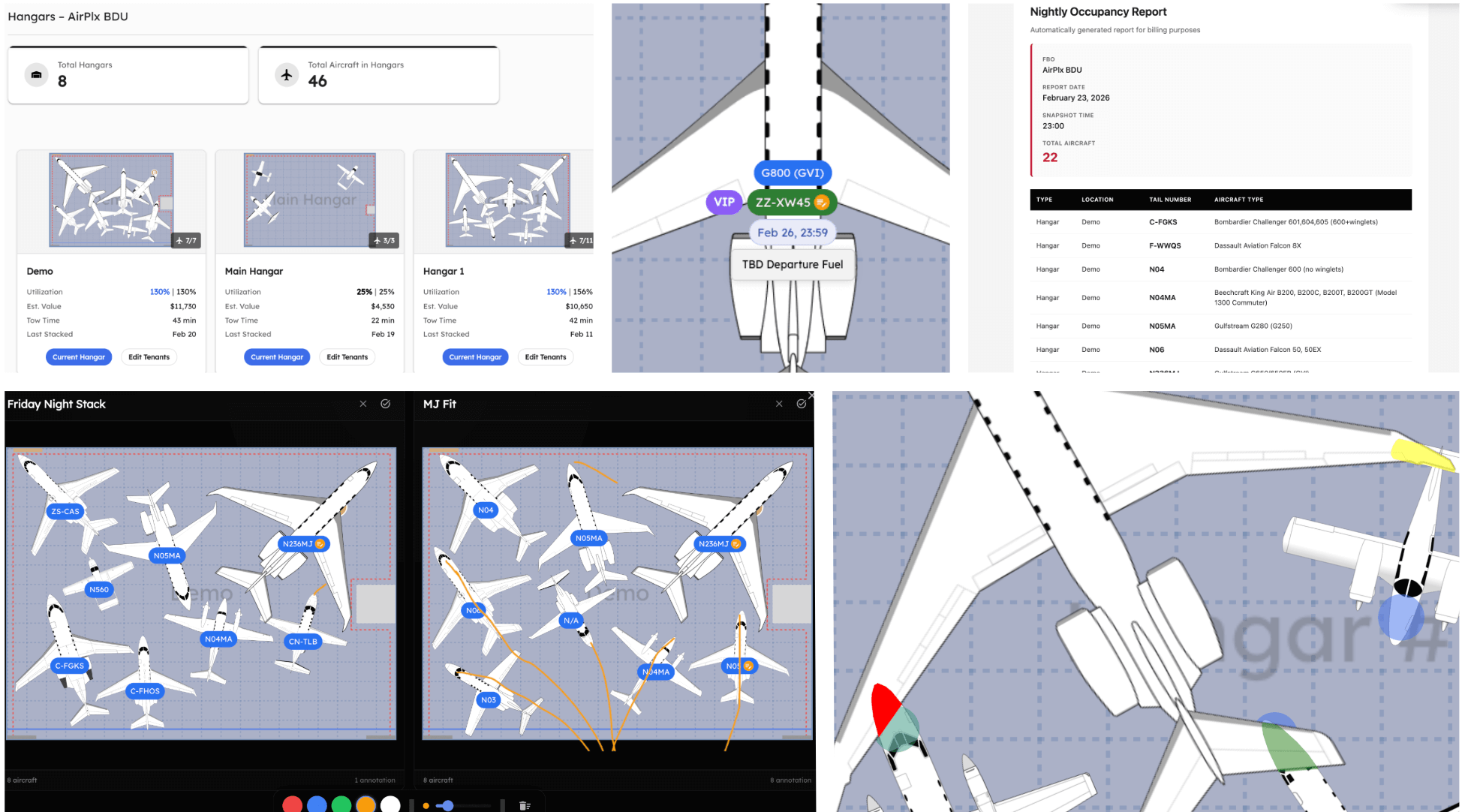

We ran simulations on these incoming aircraft using AirPlx AutoStack. Here's what the data shows—and what it means for your operation.

Dassault Falcon 10X: The Widest Cabin Takes Flight

The Falcon 10X makes its maiden flight in 2026, with customer deliveries expected in 2027. Dassault is positioning it against the Bombardier Global 7500 and Gulfstream G700—and the specs back up that ambition.

What makes it different:

- Cabin: 9 ft 1 in wide by 6 ft 8 in tall—the largest of any purpose-built business jet

- Range: 7,500 nm at Mach 0.85 (New York to Tokyo, nonstop)

- Speed: Mach 0.925 maximum

- Engines: Rolls-Royce Pearl 10X with 18,000 lbf thrust each

- Price: $75 million

The 10X features carbon fiber wings—a first for Dassault business jets—and can access steep approaches like London City Airport. Its fly-by-wire system includes automated return to level flight, emergency descent modes, and noise abatement automation that could allow two pilots to fly 15-hour missions that currently require three crew.

The Falcon 10X: 110-foot wingspan, 26-foot tail height, $75 million price tag

The Falcon 10X: 110-foot wingspan, 26-foot tail height, $75 million price tag

Hangar Capacity Impact

Dimensions: 110 ft length × 110 ft wingspan × 26 ft tail height

We modeled the Falcon 10X in a typical 30,000 sq ft hangar currently configured for mid-size jets. The results:

- Before: 6 aircraft (mix of Challenger 350s and Citation Latitudes)

- After adding one 10X: 4 aircraft maximum

- Capacity loss: 33% reduction in aircraft count

The 10X's wingspan alone requires 12-foot wingtip clearances on each side—standard for ultra-long-range handling. In a hangar optimized for super-mids, that's a 24-foot buffer zone that didn't exist before.

Revenue math: At $450/night for transient hangar fees on an ultra-long-range aircraft, a single Falcon 10X visit generates what three light jets would. But only if you can fit it. FBOs with 28-foot door heights and 120+ foot spans will capture this premium traffic. Everyone else watches it taxi to the competitor down the field.

Who sees these aircraft: Large FBOs at major metros and popular destinations (Teterboro, Van Nuys, Aspen, Palm Beach). Regional FBOs won't see Falcon 10X traffic—the owners flying $75M jets don't land at 5,000-foot strips.

HondaJet Echelon: Light Jet Goes Transcontinental

Honda Aircraft begins first flight testing of the Echelon in 2026, with type certification expected in 2028. It's being positioned as the first single-pilot-certified light jet capable of true transcontinental range.

Key specifications:

- Range: 2,625 nm (New York to Los Angeles, nonstop)

- Wingspan: 56 ft 4 in (estimated based on HondaJet Elite scaling)

- Ceiling: 47,000 feet—highest in the light jet category

- Speed: 450 knots maximum cruise

- Capacity: Up to 11 occupants

- Engines: Williams International FJ44-4C turbofans

- Price: $10-12 million

The Echelon's Garmin G3000 avionics include autoland and autobrake systems. Its cabin stands 62 inches tall with 120 cubic feet of cargo space—nearly twice the competition. Honda reports almost 500 letters of intent already signed.

The HondaJet Echelon: First single-pilot light jet with true transcontinental range

The HondaJet Echelon: First single-pilot light jet with true transcontinental range

The Route Pattern Shift

This is where regional FBOs need to pay attention.

Current light jet traffic patterns assume fuel stops. A Phenom 300 flying JFK to LAX stops in Kansas or Texas. Those mid-continent FBOs capture fuel sales, overnight hangar fees, and crew services.

The Echelon eliminates that stop. With 500 orders in the pipeline and certification in 2028, here's what changes:

FBOs that lose traffic:

- Mid-route fuel stops on transcontinental corridors

- Smaller airports where light jets currently divert due to range

FBOs that gain traffic:

- Destination airports now accessible by owner-operators

- Smaller coastal airports within range of major metros

- Airports near second homes and vacation properties

Revenue impact: A regional FBO averaging 3 light jet fuel stops daily on the East-West corridor could see 15-20% reduction in transient light jet traffic by 2029. That's $180,000-$240,000 in annual fuel revenue at risk—assuming $500 average fuel purchase per stop.

Who should prepare: FBOs on transcontinental corridors (I-70 airports, Texas fuel stops, Great Plains regionals). Also destination FBOs in resort markets—you're about to see owner-operators who previously flew mid-size jets.

Cessna Citation CJ4 Gen3: Autoland Comes to Light Jets

The Citation CJ4 Gen3 enters service in 2026 as the first Citation to feature Garmin's G3000 PRIME avionics suite with Emergency Autoland.

What's new:

- Avionics: Garmin G3000 PRIME with 40% larger secondary displays

- Safety: Emergency Autoland activates if pilots become incapacitated—or after 30 minutes of no pilot activity

- Weather: GWX8000 StormOptix radar

- Navigation: 3D SafeTaxi displays FBOs and hangars

- Range: 2,165 nm with 11 occupants

The Emergency Autoland system allows passengers to press a single button if the pilot is incapacitated. The aircraft then finds the nearest suitable airport, lands itself, and brakes to a stop.

The Citation CJ4 Gen3: Garmin G3000 PRIME avionics with Emergency Autoland

The Citation CJ4 Gen3: Garmin G3000 PRIME avionics with Emergency Autoland

Ground Handling: What Your Line Crew Needs to Know

The Gen3's sensor arrays create new ground damage risks. Here's what to protect:

Critical sensor locations:

- ADS-B transponder antennas: Mounted on upper and lower fuselage centerline. Standard Citation locations, but the Gen3's ADS-B In capability adds receivers that weren't on earlier models.

- Weather radar: GWX8000 radome in the nose. More sensitive than predecessor systems—don't let tow bars contact the nose cone.

- GPS/WAAS antennas: Top of fuselage, aft of cockpit. Keep personnel off the fuselage during repositioning.

- TCAS II antennas: Top and bottom fuselage. The Runway Occupancy Awareness system uses these for ground traffic detection.

Towing procedure updates:

- Confirm avionics are powered down before attaching tow bar (Autoland system monitors for movement)

- Use CJ4-specific tow bar—Gen3 nose gear geometry unchanged from Gen2

- Maximum towing speed: 5 mph in hangar, 10 mph on ramp

- Two-person minimum for repositioning (spotter required for wingtip clearance)

Damage cost reality: A single ADS-B antenna replacement runs $8,000-$12,000 including labor. TCAS antenna damage can ground the aircraft for 3-5 days awaiting parts. The $50,000 figure in our intro? That's a radome strike requiring full weather radar calibration.

Who sees these aircraft: Everyone. The CJ4 is Cessna's best-selling light jet. Gen3 deliveries will flow to corporate flight departments and charter operators nationwide. This is the aircraft your line crew will handle weekly.

Gulfstream G400: The G450 Replacement Lands

The Gulfstream G400 made its first flight in August 2024 and should receive certification in late 2025 or early 2026. It completes Gulfstream's five-aircraft next-generation family alongside the G500, G600, G700, and newly-certified G800.

Specifications:

- Dimensions: 89 ft 4 in length × 86 ft wingspan × 25 ft 5 in tail height

- Range: 4,200 nm at Mach 0.85

- Avionics: Symmetry Flight Deck with active control sidesticks

- Engines: Pratt & Whitney Canada PW812GA

- Cabin: Same fuselage as G500 and G600

The G400 targets operators who found the G450 perfect for their missions but want modern avionics and improved fuel efficiency. Expect 8-12% fuel savings over the G450 it replaces.

The Gulfstream G400: Completing the five-aircraft next-generation family

The Gulfstream G400: Completing the five-aircraft next-generation family

GPU and Ground Power Requirements

The PW812GA engines on the G400 require specific ground power:

- GPU specification: 28.5 VDC, 1000+ amp continuous

- AC power: 115/200 VAC, 400 Hz, 90 kVA minimum

- Connector: Standard Gulfstream 3-pin DC, NATO STANAG for military-spec GPUs

If your GPU fleet was sized for G450s (PW307A engines), you're likely fine. The PW812GA has similar ground power requirements. However, the Symmetry Flight Deck's increased avionics load means longer GPU connection times during preflight—budget an extra 10-15 minutes versus G450 turnarounds.

Fleet transition timeline: Gulfstream delivered 39 G450s in its final production year (2018). Those aircraft are now 7+ years old. Corporate flight departments on 10-year replacement cycles will start transitioning to G400s in 2026-2028. Expect gradual fleet replacement, not overnight change.

Who sees these aircraft: Mid-to-large FBOs serving corporate aviation. The G400's 4,200 nm range covers most domestic missions and transatlantic legs—it's a workhorse replacement for corporate flight departments.

What This Means for Your FBO

Not all FBOs face the same impact. Here's how these aircraft affect different operations:

Large Metro FBOs (TEB, VNY, SDC, PBI)

Prepare for: Falcon 10X traffic starting late 2027. These $75M aircraft expect white-glove service.

Action items:

- Confirm hangar door clearances for 110-foot wingspans and 26-foot tail heights

- Train dedicated crew for ultra-long-range handling (premium aircraft = premium service)

- Review pricing: $400-500/night hangar fees are standard for this segment

- Establish Dassault service relationships now

Revenue opportunity: $150,000-$250,000 annually in additional hangar and handling fees per regular Falcon 10X customer.

Regional and Mid-Size FBOs

Prepare for: CJ4 Gen3 traffic starting mid-2026. These will become your bread-and-butter transient aircraft.

Action items:

- Update SOPs for G3000 PRIME-equipped aircraft (see sensor locations above)

- Train all line crew on Gen3 ground handling by Q2 2026

- Stock common CJ4 consumables (tires, brake pads, oil)

Risk to monitor: Echelon impact on fuel stop traffic. If you're on a transcontinental corridor, model your exposure.

Destination FBOs (Resort Markets, Second-Home Regions)

Prepare for: HondaJet Echelon traffic starting 2029. Owner-operators who couldn't reach you before.

Action items:

- Single-pilot services become more important (pilot rest areas, local transportation)

- Light jet hangar space may see increased demand

- Marketing opportunity: "Now accessible by transcontinental light jets"

Revenue opportunity: New customer segment that previously flew midsize jets or drove.

Your 2026 Checklist

Before year-end 2025:

- Audit hangar clearances: 110-foot wingspan, 26-foot tail height for ultra-long-range

- Update towing SOPs for G3000 PRIME-equipped aircraft

- Train line crew on CJ4 Gen3 sensor locations (ADS-B, TCAS II, weather radar)

- Verify GPU fleet supports 1000+ amp continuous at 28.5 VDC

- Model revenue exposure if you're on transcontinental corridors

- Run hangar capacity simulations with new aircraft dimensions

Early 2026:

- Establish relationships with Dassault, Honda, and Textron service reps

- Develop pricing strategy for transcontinental light jets

- Prepare marketing materials for Falcon 10X-capable facilities

- Brief operations team on fleet transition timelines

The aircraft pipeline for 2026 isn't speculation—these programs are in flight test with published specifications. The FBOs that prepare now capture premium customers when deliveries begin.

See How These Aircraft Fit Your Hangar

We've already added the Falcon 10X, HondaJet Echelon, and CJ4 Gen3 to AirPlx AutoStack's aircraft database. Run simulations on your actual hangar dimensions to see capacity impact before these aircraft arrive.