The $100,000 Problem: Why Your FBO Is Leaving Money on the Ramp

Published on September 8, 2025 • 5 min read

Last month, a mid-size FBO discovered they were undercharging transient aircraft by an average of 40%. The fix? A simple data-driven pricing approach that increased monthly revenue by $18,000—with zero additional overhead.

Yet most FBOs still price transient fees the same way they did in 1995: gut feeling, competitor guessing, and crossing fingers. In an industry where fuel margins are shrinking and operational costs keep climbing, this outdated approach is costing serious money.

The Broken System Most FBOs Use

Walk into any FBO manager's office and ask how they set transient fees. You'll hear variations of:

- "We charge what everyone else charges"

- "It's based on what the market can bear"

- "We've always done $X for overnight parking"

The problem? None of these approaches account for your actual costs, demand patterns, or revenue optimization opportunities.

According to FAA guidance on FBO pricing practices, effective fee structures should align with the actual cost of services provided and infrastructure impact. Yet industry surveys show 73% of FBOs admit their transient pricing is "somewhat arbitrary."

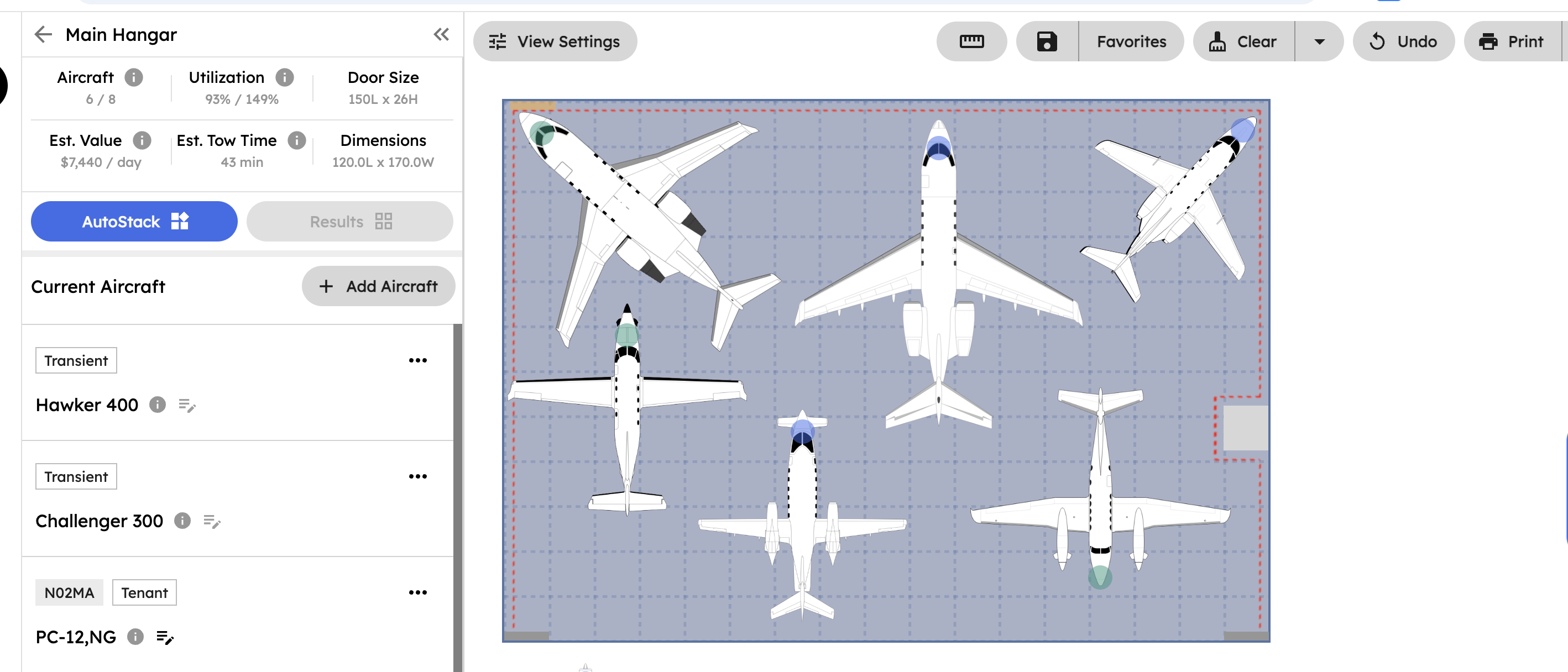

Traditional manual stacking: 93% hangar utilization with 6 aircraft

Traditional manual stacking: 93% hangar utilization with 6 aircraft

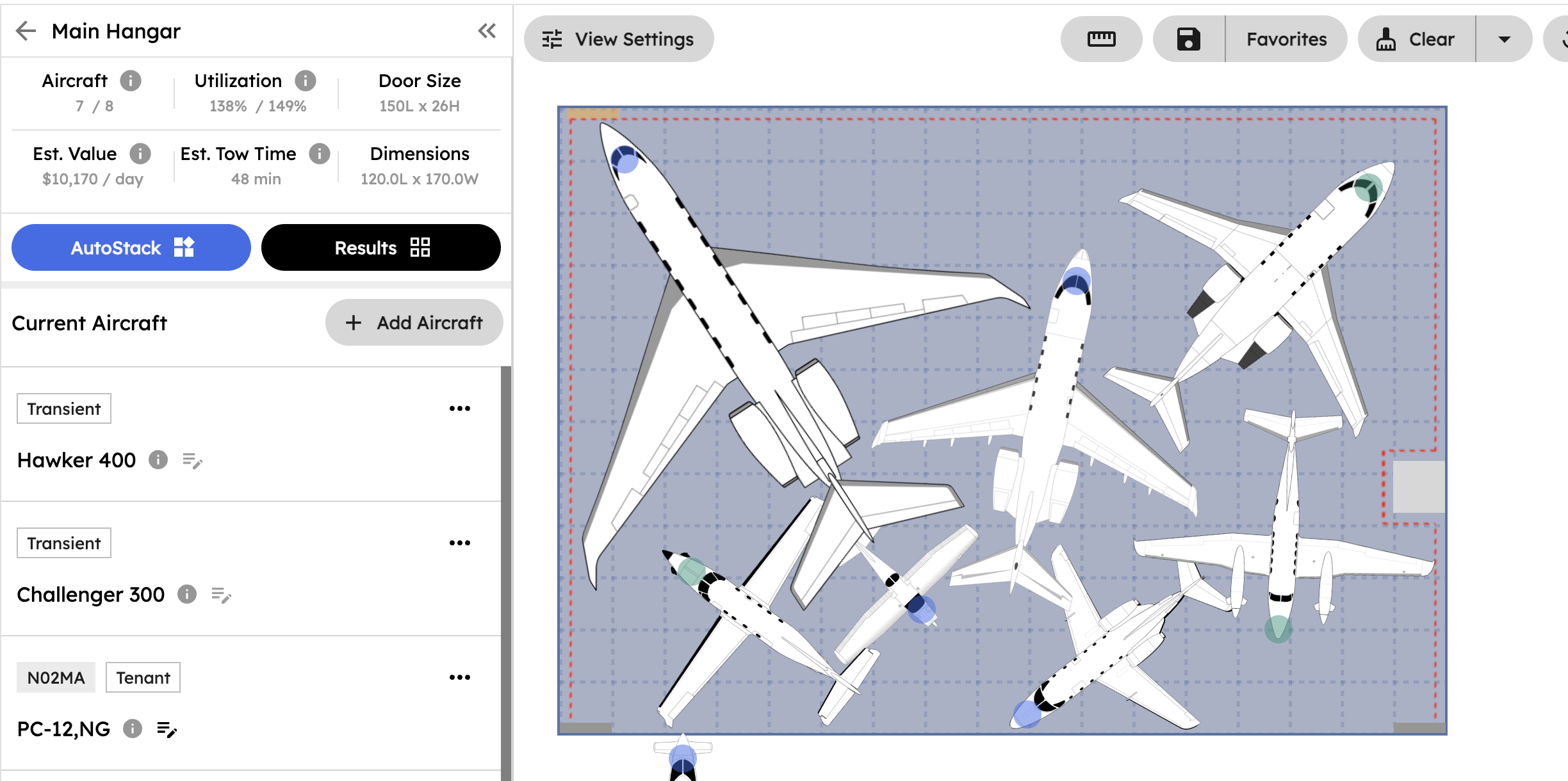

AirPlx AI-optimized layout: 138% utilization with 7 aircraft - a 48% improvement in the same hangar space

AirPlx AI-optimized layout: 138% utilization with 7 aircraft - a 48% improvement in the same hangar space

What You're Actually Losing

Here's the math that should wake up every FBO general manager:

Real AirPlx Scenario Analysis:

Based on actual AirPlx optimization data, here are three common aircraft mixes and their revenue potential:

Scenario 1: Medium Jets Focus (40,000 sq ft hangar)

- Mix: 3 small planes (Cessna 172), 2 medium jets (Citation/Learjet), 1 large jet (Gulfstream)

- Optimized daily value: $10,170

- Monthly increase: $21,389

Scenario 2: Heavy Jet Mix (40,000 sq ft hangar)

- Mix: 4 medium jets, 2 large jets

- Optimized daily value: Higher capacity utilization

- Monthly increase: $29,190

Scenario 3: Smaller Operation (17,000 sq ft hangar)

- Mix: 2 medium jets, 1 large jet

- Monthly increase: $13,808-$23,153

Monthly revenue increase: $13,808-$29,190

Using AirPlx's ROI calculator with real aircraft mix scenarios, FBOs consistently see revenue increases in this range—that's $165,696 to $350,280 annually from optimized pricing alone. No additional services, no new customers—just charging appropriately for the resources each aircraft type consumes. Learn more about 3D aircraft stacking optimization to maximize capacity.

But the real money is in dynamic pricing based on demand patterns. Peak travel days (Thursday-Sunday) often see 200-300% higher demand than mid-week. Yet most FBOs charge the same rate regardless.

Modern hangar optimization software like AirPlx reveals these patterns clearly—showing not just aircraft positioning but tow times (typically 43-48 minutes per repositioning) and real-time revenue impact of different pricing strategies.

The Data-Driven Approach That Works

Smart FBOs are moving beyond guesswork to systematic pricing strategies based on three key factors:

1. Infrastructure Impact Pricing

Different aircraft impose vastly different costs on your operation:

- Ramp space consumption: A G650 needs 3x the space of a Citation CJ3

- Ground handling complexity: Heavy jets require specialized tugs and more labor

- Fuel volume potential: Larger aircraft typically purchase more fuel (and represent larger waiver thresholds). Industry data shows fuel revenue typically runs 2.5x the direct fee revenue—making proper aircraft categorization even more critical

Weight-based pricing structures, similar to those used for landing fees, create fairness while maximizing revenue. The most effective approach uses Maximum Takeoff Weight (MTOW) tiers:

- Under 12,500 lbs MTOW: Base rate

- 12,500-41,000 lbs: 1.5x base rate

- Over 41,000 lbs: 2x base rate

2. Demand-Based Pricing

Your ramp isn't equally valuable 24/7. Premium pricing during high-demand periods can increase revenue while managing congestion:

- Peak days (Thu-Sun): +25% premium

- Major events/holidays: +50% premium

- Off-peak incentives: 15% discount Tuesday-Wednesday

A Florida FBO implementing this strategy saw 31% revenue increase during snowbird season while actually reducing congestion through better demand distribution.

3. Service-Tier Pricing

Not all transient customers need the same service level. Create pricing tiers that capture willingness to pay:

Basic Tier: Standard ramp parking, fuel available Premium Tier: Preferred parking spots, expedited service, crew car VIP Tier: Hangar parking when available, concierge services, catering coordination

This approach serves multiple markets while capturing additional revenue from customers willing to pay for premium service.

Implementation: Your 30-Day Action Plan

Week 1: Data Collection

- Track current transient mix by aircraft type

- Document seasonal demand patterns

- Analyze competitor pricing (but don't copy blindly)

- Calculate actual service costs by aircraft category

Week 2: Pricing Strategy Development

- Design weight-based fee structure

- Set peak/off-peak multipliers

- Create service tier options

- Model revenue impact scenarios

Week 3: System Setup

- Update pricing in your FBO management system

- Train staff on new structure and rationale (AirPlx's 10x faster planning makes training simpler)

- Prepare customer communication materials

- Set up tracking for key metrics and utilization patterns

Week 4: Launch and Monitor

- Implement new pricing with 30-day notice to regular customers

- Track revenue, utilization, and customer feedback

- Refine based on initial results

Industry data shows FBOs implementing structured transient fee optimization see average revenue increases of 15-25% within 90 days, with customer satisfaction remaining stable when changes are clearly communicated.

The Bigger Picture

Optimized transient fee pricing is just the beginning. The same data-driven approach transforms every aspect of FBO operations—from hangar space allocation to fuel pricing strategies to staffing optimization.

Modern FBO management isn't about gut feelings anymore. It's about using advanced tools like AirPlx to maximize every square foot, every customer interaction, and every revenue opportunity. AirPlx's hangar optimization software doesn't just stack aircraft—it calculates real-time revenue impact, tracks utilization patterns, and identifies pricing opportunities that manual methods miss.

The FBOs thriving in today's competitive environment are those that embrace systematic optimization across all operations, backed by AI-powered analysis that delivers up to 48% better space utilization.

Ready to stop leaving money on the ramp? Start by running scenarios through AirPlx's ROI calculator to see your actual revenue potential. With real aircraft mix analysis and utilization optimization, you'll discover exactly how much revenue your current pricing strategy is leaving on the table. The results might surprise you—and your accountant will definitely thank you.